Macroeconomic Overview

US equity futures gave up slight overnight gains to go red ahead of economic data and continued to trend lower after stronger Industrial Production and NY Fed Manufacturing results. University of Michigan preliminary sentiment also weighed on markets, coming in light of expectations. The sentiment spread narrowed from 10.2 to 3.5 in a more negative shift toward recessionary levels. US Treasury yields pushed higher on the mixed data, but the implied probability of a Fed pause for September remained around 97%.

At the end of the trading session on Sunday, the New York Stock Exchange indices were losing steam. The DJIA added 0.83% closing at 34,618.77. The S&P 500 broad market index gained 1.22% closing at 4,450.32. The NASDAQ gained 1.75% and closed at 15,202.40.

The precious metals traded bullish. Gold added 0.31% closing at 1,950.75. Silver lifted by 0.65% and closed at 23.483. Platinum lifted by 0.28% and closed at 934.95. Palladium lifted by 0.26% and closed at 1,254.53. Copper stayed at closing at 3.7977.

Crude oil futures traded bullish. Brent added 0.82% and closed at 94.70. WTI lifted by 0.77% closing at 90.86. Oil prices fell slightly as traders hunkered down in anticipation of several key central bank meetings this week, although the prospect of a tighter market, on more supply cuts, kept prices at 10-month peaks.

Executive Summary

US:

Goldman Sachs predicts the Federal Reserve won't raise interest rates in October-November due to labor market improvements and better inflation news. They expect the "dot plot" to show a majority favoring one more hike. Some investors, like J.P. Morgan and Janus Henderson, believe rate hikes are done. A 98% chance of no change in September, and 72% for October-November, is expected. If inflation cools, rate cuts may happen gradually in the next year.

Eurozone:

ECB President Christine Lagarde took an unprecedented step by confiscating mobile phones from policymakers during a meeting to prevent information leaks. This move aimed to address past leaks that affected her and her predecessor. It occurred as the ECB was about to select Claudia Buch as the top banking supervisor due to a previous leak. Additionally, a Reuters report revealing the ECB's plan to raise an inflation forecast influenced expectations of an interest rate hike. In a separate development, the French government plans to temporarily allow retailers to sell road fuel below cost to ease inflationary pressures on households, also addressing "shrinkflation" concerns in food retailing.

Asia:

In Australia, Michele Bullock became the first woman to lead the Reserve Bank of Australia (RBA). Bullock aims to bring inflation back into the RBA's 2%-3% target range while ensuring a soft economic landing, in contrast to other countries facing economic challenges due to rate hikes or recession forecasts.

China:

China Evergrande Group's shares plunged 25% due to the detention of staff at its wealth management unit, raising concerns about potential investigations worsening the financial crisis. The stock hit a two-week low, later recovering slightly to an 11% drop. Evergrande reported a net loss of 33 billion yuan ($4.5 billion) for January-June, an improvement from the previous year.

EM:

Thailand's new cabinet approved on Monday a budget plan for higher spending of 3.48 trillion baht ($97.64 billion) and a larger budget deficit of 693 billion baht for the fiscal year 2024, Deputy Finance Minister Julapun Amornvivat told reporters.

Infographics

The United States

The University of Michigan’s consumer sentiment measure declined again, but the expectations index edged higher.

- UMich Consumer Sentiment Index. Source: fred.stlouisfed.com *

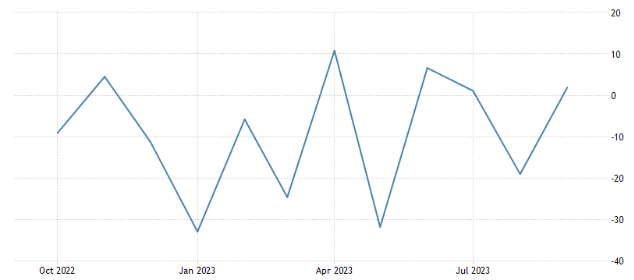

Empire Manufacturing, the first regional factory report of the month (from the NY Fed), showed some improvement in September. However, this index has been volatile over the past two years.

- Empire State Manufacturing Index. Source: tradingeconomics.com *

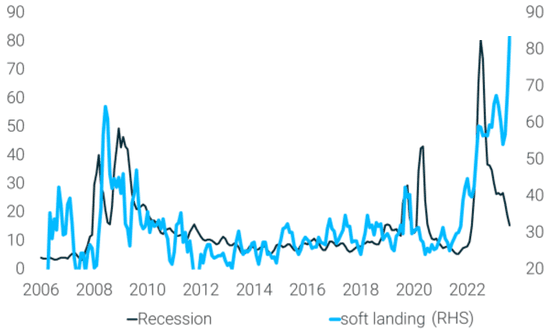

Too much enthusiasm about the economy?

- Google Searches Mentioning Soft Landing. Source: tslombard.com *

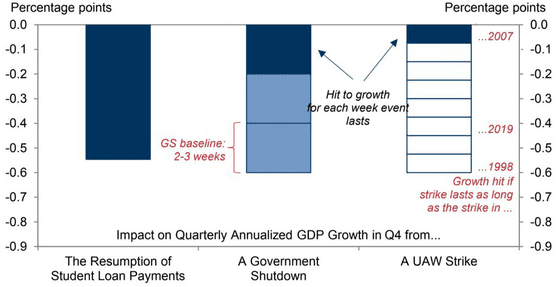

How might the resumption of student loan payments, coupled with the UAW strike, impact the economic landscape in the upcoming quarter?

- US Projected Q4 Growth. Source: goldmansachs.com *

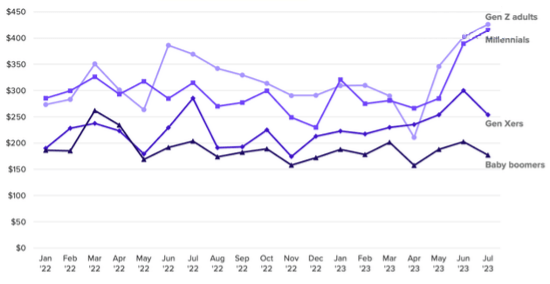

Which sectors are likely to face challenges due to the resumption of student loan payments?

- Potential Sector Underperformance due to Student Loan Resumptions. Source: morningconsult.com *

Opinions about the markets

Goldman Sachs strategists predict that the Federal Reserve is unlikely to raise interest rates at its October 31-November 1 meeting. They anticipate factors like labor market improvements, better inflation news, and potential economic growth challenges in Q4 may convince the Federal Open Market Committee (FOMC) to skip a rate hike this year. However, they expect the FOMC's "dot plot," reflecting interest rate projections, to show a narrow majority favoring one more hike.

Some major investors, including J.P. Morgan Asset Management and Janus Henderson Investors, believe the Fed has completed its rate hikes after an aggressive tightening cycle. Currently, there's a 98% chance that rates will remain unchanged at the September 19-20 meeting. The odds for no change at the October 31-November 1 meeting are around 72%.

Goldman's strategists also suggest that if inflation cools, rate cuts might occur gradually in the next year. They anticipate the Fed raising its 2023 U.S. growth estimate to 2.1% and reducing the unemployment rate and core inflation estimates. The "dot plot" and Fed's long-run rate estimate will be closely watched for insights into future monetary policy, impacting bond yields and market expectations. The bond market has seen decreases in rate cut predictions for 2024, with potential implications for yield curves and investor expectations. The stagnation in the market has caused concerns, with investors facing consecutive months of losses.

Eurozone

The housing market in UK continues to struggle.

- UK RICS Price Expectations vs House Prices. Source: pantheon.com *

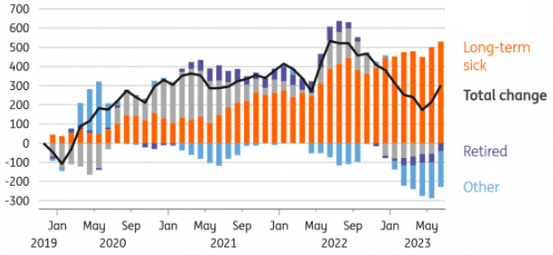

UK workers inactivity begun to higher again.

- UK Workers Inactivity. Source: macrobond.com *

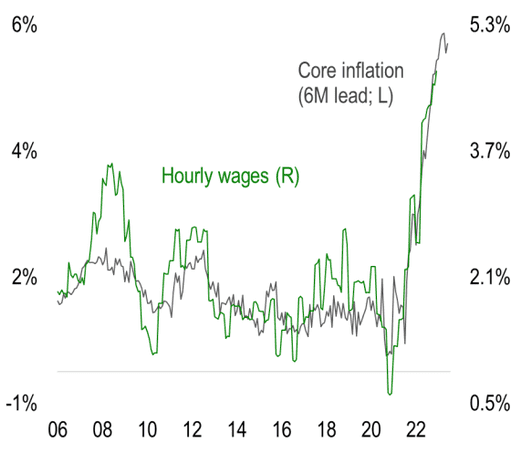

Concerns about a wage-price spiral persist.

- ECB Wage-Price Spiral Evasion. Source: numera.com *

Opinions about the markets

European Central Bank (ECB) President Christine Lagarde took the unprecedented step of confiscating mobile phones from policymakers during a meeting to prevent leaks of crucial information ahead of a policy decision. This move aimed to address the issue of information leaks that have affected both her presidency and that of her predecessor, Mario Draghi. The decision to collect the mobile phones occurred as the ECB was about to select Claudia Buch as the ECB's top banking supervisor. The action was prompted by a previous incident where the choice of the current chair, Andrea Enria, was leaked to the media before the official release.

This development followed a Reuters report that revealed the ECB's intention to raise a key inflation forecast, which led to expectations of an interest rate hike. While most economists and traders had anticipated no rate change, the Reuters report influenced a change in their views.

In a separate development, the French government plans to temporarily lift a ban on retailers selling road fuel below cost to address inflationary pressures on households. Prime Minister Elisabeth Borne announced this measure, which aims to ease the impact of rising pump prices. The ban had prevented distributors from further reducing fuel prices, and this temporary lift is designed to benefit the French people without fuel subsidies. Borne also mentioned that companies would be required to indicate when they modify product sizes to address "shrinkflation" concerns in food retailing.

Asia

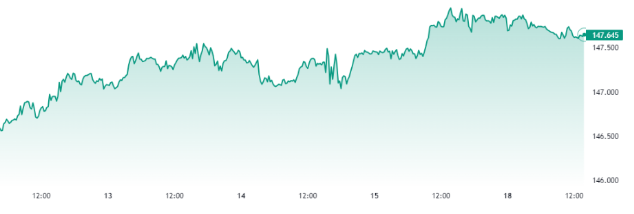

Dollar-yen hit resistance at 148.

- USD/JPY. Source: tradingview.com *

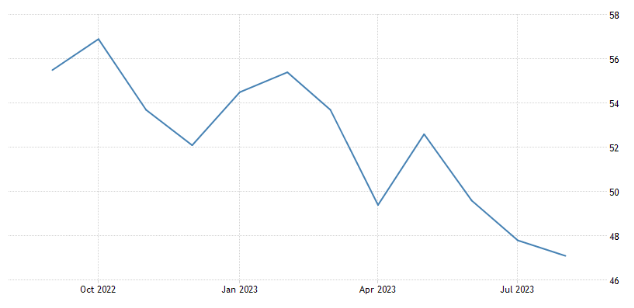

The contraction in New Zealand’s business activity has accelerated.

- NZ Services PMI. Source: tradingeconomics.com *

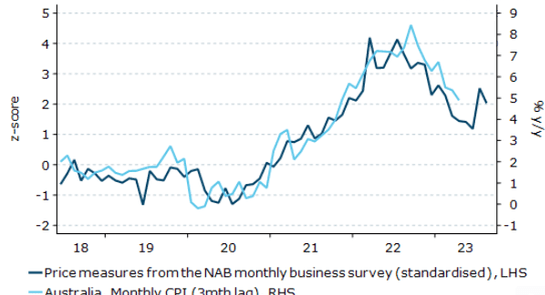

Australia’s inflation expectations moderated this month. However, inflation expectations among businesses remain elevated.

- Australia CPI. Source: anz.com *

Opinions about the markets

China Evergrande Group's shares dropped 25% following the detention of some staff at its wealth management unit, raising concerns about new investigations that could exacerbate the company's ongoing financial crisis.

Evergrande's stock initially fell to a two-week low of HK$0.465, down 25%, but later recovered slightly to an 11% drop. The company reported a net loss of 33 billion yuan ($4.5 billion) for January-June, a significant improvement from the previous year's 66.4 billion yuan loss.

Meanwhile, in Australia, Michele Bullock has assumed the role of the first woman to head the Reserve Bank of Australia (RBA). She inherits an economy characterized by moderating inflation, strong employment, and ongoing growth. Bullock, who has been the deputy governor since April 2022, faces the task of managing the country's monetary policy.

The RBA had raised rates by 400 basis points over 13 months but has seen inflation ease from its peak. Bullock is committed to maintaining a focus on bringing inflation back into the RBA's target range of 2%-3%. The Australian economy aims for a soft landing, in contrast to other countries like New Zealand and Germany, which have faced economic challenges due to rate hikes or recession forecasts.

China

The renminbi is sagging again.

- USD/RMB. Source: xe.com *

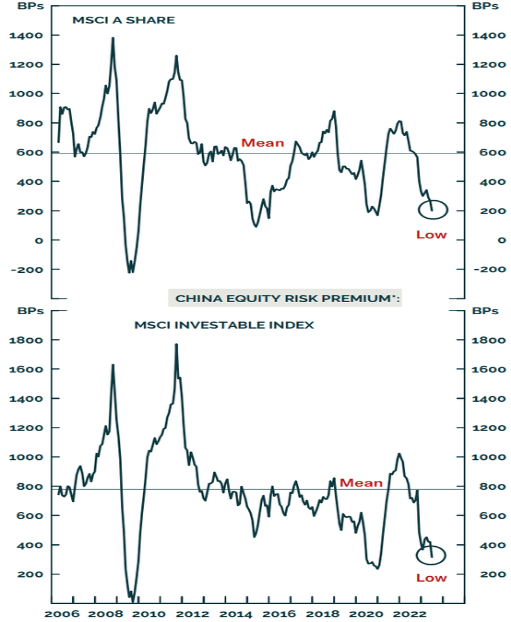

China’s equity risk premium has been depressed, suggesting elevated stock valuations relative to bonds.

- China Equity Risk Premia. Source: bcaresearch.com *

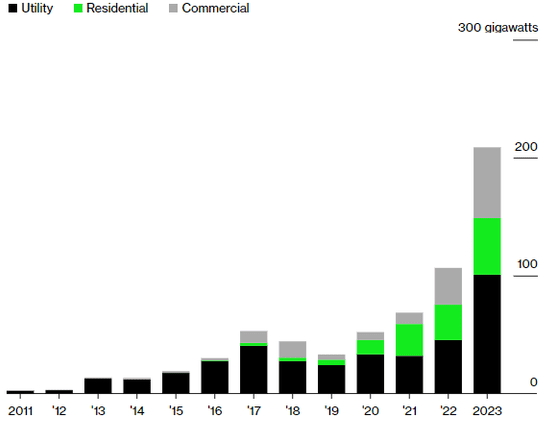

Here is a look at solar capacity.

- China Solar Energy Generation and Capacity. Source: bloomberg.com *

Emerging Markets

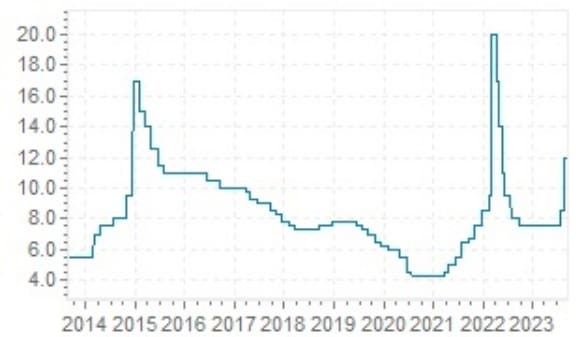

The Russian central bank hiked rates again to stabilize the nation’s sinking currency.

- CBR Key Rate. Source: global-rates.com *

Mathematical Model Report

The overboughtness level of the U.S. stock market is 57.6%. Most of the key economic indices show the sluggish recovery of the main economies. We advise staying cautious and not taking any excessive risks. We are approaching a very dangerous level of overboughtness. We think it is prudent to cut/close positions on the SP 500 Index and wait. Recall that the major banks are predicting a recession in Q3 or Q4.

- US Stocks Market & Recession (NBER). Source: isabelnet.com *

The macroeconomic environment is conducive to growth. However, you should be careful in such an overheated market and allocate assets wisely (go to the section on investment ideas).

- Stock Market Short-Term Forecast. Source: isabelnet.com *

The appropriateness of investing over the five-year horizon. It is worth keeping in mind the overbought levels and the levels where the index is likely to come. Buying bonds will remain attractive for the near-term investments.

- Stock Market Equity Risk Premium. Source: isabelnet.com *

The indicator is rebounding to the bullish zone, fueled by the news about the Fed skipping the possibility of the rate hike on the next meeting; As before, we advise in favor of taking short positions, in the long-term run. We recommend staying away from buying and staying on the sidelines, because local strong moves in both directions could be possible. However, in the long run we might see a recession.

- Stock Market Bull and Bear Indicator. Source: isabelnet.com *

The markets are not expected to recover anytime soon until 10 years from now. Until then, all odds are stacked against a 30% decline over the next year and a drop to 10% over the next 5 years. Let's stick with that prediction.

- Stock Market Long-Term Forecast (Dividends Reinvested). Source: isabelnet.com *

Current Market Situation

- Current Market Situation (Crude Oil Brent). Source: finviz.com *

Current Market Situation (Gold). Source: finviz.com *

Current Market Situation (Nasdaq 100). Source: finviz.com *

Current Market Situation (S&P 500). Source: finviz.com *

*Snapshots are made at the moment of report creation. *

The Global State of the Global Market

- Current Market Situation (Worldwide). Source: finviz.com *